At this point the economist PhD readers will scream: "this is total BS - after all you have bilateral netting which eliminates net bank exposure almost entirely." True: that is precisely what the OCC will say too. As the chart below shows, according to the chief regulator of the derivative space in Q2 netting benefits amounted to an almost record 90.8% of gross exposure, so while seemingly massive, those XXX trillion numbers are really quite, quite small... Right?

|

| Add caption |

...Wrong. The problem with bilateral netting is that it is based on one massively flawed assumption, namely that in an orderly collapse all derivative contracts will be honored by the issuing bank (in this case the company that has sold the protection, and which the buyer of protection hopes will offset the protection it in turn has sold). The best example of how the flaw behind bilateral netting almost destroyed the system is AIG: the insurance company was hours away from making trillions of derivative contracts worthless if it were to implode, leaving all those who had bought protection from the firm worthless, a contingency only Goldman hedged by buying protection on AIG. And while the argument can further be extended that in bankruptcy a perfectly netted bankrupt entity would make someone else whole on claims they have written, this is not true, as the bankrupt estate will pursue 100 cent recovery on its claims even under Chapter 11, while claims the estate had written end up as General Unsecured Claims which as Lehman has demonstrated will collect 20 cents on the dollar if they are lucky.

The point of this detour being that if any of these four banks fails, the repercussions would be disastrous. And no, Frank Dodd's bank "resolution" provision would do absolutely nothing to prevent an epic systemic collapse.

...

Lastly, and tangentially on a topic that recently has gotten much prominent attention in the media, we present the exposure by product for the biggest commercial banks. Of particular note is that while virtually every single bank has a preponderance of its derivative exposure in the form of plain vanilla IR swaps (on average accounting for more than 80% of total), Morgan Stanley, and specifically its Utah-based commercial bank Morgan Stanley Bank NA, has almost exclusively all of its exposure tied in with the far riskier FX contracts, or 98.3% of the total $1.793 trillion. For a bank with no deposit buffer, and which has massive exposure to European banks regardless of how hard management and various other banks scramble to defend Morgan Stanley, the fact that it has such an abnormal amount of exposure (but, but, it is "bilaterally netted" we can just hear Dick Bove screaming on Monday) to the ridiculously volatile FX space should perhaps raise some further eyebrows...

Average:

4.97059

Your rating: None Average: 5 (34 votes)

Similar Articles You Might Enjoy:

Fitch: Financial Companies Hold 99.7% Of All Derivative Contracts

How Goldman's Counterparty Valuation Adjustment (CVA) Desk Saved The Firm From An AIG Blow Up (And Opens Up A Whole New Can Of Wormy Questions)

The Real "Margin" Threat: $600 Trillion In OTC Derivatives, A Multi-Trillion Variation Margin Call, And A Collateral Scramble That Could Send US Treasurys To All Time Records...

Is GS Tempting The Interest Rate Black Swan With 1,056% Risk Exposure?

Is GS Tempting The Interest Rate Black Swan With 1,056% Risk Exposure?

Sat, 09/24/2011 - 06:28 |

Motley Fool

Motley Fool

Light the fuse. :P

Login or register to post comments

Sat, 09/24/2011 - 07:02 |

spiral_eyes

spiral_eyes denials to begin in 3..2.....1

"who is this zero hedge and why should we care??"

Login or register to post comments

Sat, 09/24/2011 - 08:12 |

max2205

max2205

MS=AIG? Wow

Lol some agency needs to set exposure limits AND leverage limits. Right

Lol. The Fed is stupid

Login or register to post comments

Sat, 09/24/2011 - 09:46 |

disabledvet

disabledvet

Insofar as Morgan Stanley is obviously not too big too fail (the famous "go fuck yourself" line from their CEO to Hank Paulson when as the high and mighty Goldman alum was deciding who to place Morgan Stanley with after he had placed Bear Stearns with JPMorgan. No offense of course!) then i can't see the problem with leverage. Because i don't want to see a repeat of 2008 however i to do have a problem with exposure--not because the failure of Morgan Stanley is going to bring down "the entire global financial system!" as the failure of Lehman brothers allegedly did (which is a total fallacy.) In that sense AIG is truly a case of too big to fail. We know from Hank Paulson's book the President...of the United States that is...literally blurted out "AN INSURANCE COMPANY?!" What you don't get is "the dollar amount required" pre-amble in this bookend to the "War on Terror." Obviously AIG still exists and still writes policies--it does so at the behest of American people and their interests there of. For those who think "blowing up banks" is a "cool and groovy think to do" i say this to you: in the end you may wish for that thing to fail because if it doesn't "they will remember you."

Login or register to post comments

Sat, 09/24/2011 - 11:26 |

Tunga

Tunga

"Obviously AIG still exists and still writes policies--it does so at the behest of American people and their interests there of." - disabledvet

Errt! AIG is beholden to US citizens; aka corporate entities that bare only a faint semblance to Americans.

Login or register to post comments

Sat, 09/24/2011 - 11:44 |

nope-1004

nope-1004

When I was a kid, a trillion dollars seemed like a lot of money.

Just some Sat. AM humor. LOL.

Login or register to post comments

Sat, 09/24/2011 - 12:05 |

Pinto Currency

Pinto Currency

The top six banks are sitting on the biggest A-bomb of all - the interest rate derivative bomb.

That's how they blew the debt and financial sector bubble. They forced interest rates down.

Login or register to post comments

Sat, 09/24/2011 - 15:33 |

Djirk

Djirk

I am not a big fan of guvMINT regulation, but time to step in boyz/girlz and fix this mess

Login or register to post comments

Sat, 09/24/2011 - 19:00 |

Ag Star

Ag Star

If the guvMINT had done it's job and not deregulated the banking, insurance, finance industries we would not be here today. WHO THE FUCK POLICES THEMSELVES? The constitution was written to prevent this shit but Americans didn't pay attention while they dismantled it. They ain't gonna fix anything--they are breaking it intentionally because they are mere puppets--what rock have you been living under?

Login or register to post comments

Sat, 09/24/2011 - 19:38 |

Old Poor Richard

Old Poor Richard

Too big to fail.

Too big to jail.

TOO BIG TO BAIL.

I'm with Motley Fool. It is past time to regulate. Time to light the fuse on these shitheads. Find their biggest unhedged exposures and twist the knife, triggering payouts they can't afford so that they all implode. Make the ones with insured deposits firewall those infrastructure and assets to protect the government and the depositors. Make sure the branches are open the next morning. Also ensure the ordinary non-too-big-to-bail banks are given the liquidity to keep main stream afloat as lower Manhattan slides into the Laurentian Abyss.

Login or register to post comments

Sun, 09/25/2011 - 04:40 |

AmCockerSpaniel

AmCockerSpaniel

I don't want the banks to fail. I do want the CEO's & COO's to do 20 ~ life .

Login or register to post comments

Sat, 09/24/2011 - 12:20 |

Kayman

Kayman

" only Goldman hedged by buying protection ON AIG." Goldman held a policy from the Bank of Hank. Hank, in turn, covered the bet through the daylight robbery of the American people.

America's industrial might once financed the parasitical Wall Street patty cake "industry".

Do you seriously believe that Wall Street is going to revive America ? Bonuses all around translated is "get out of Dodge"

Deficits and money printing are future claims that require careful investments in future earning assets, not squandering on pump and dump, churn and burn, jobs for the boys schemes.

Login or register to post comments

Sat, 09/24/2011 - 16:00 |

robertocarlos

robertocarlos Hank is number one in the hood. He'll be the first to pay.

Login or register to post comments

Sat, 09/24/2011 - 11:16 |

Seize Mars

Seize Mars

MS=AIG? Wow

Lol some agency needs to set exposure limits AND leverage limits. Right

Lol. The Fed is stupid

No, they just need to stop asking taxpayers for a backstop. There is nothing wrong with grownups getting in over their heads - as long as they are the only ones who would pay...

Login or register to post comments

Sat, 09/24/2011 - 13:07 |

eisley79

eisley79 the people who did it definitely wont ever pay. But the whole world is going to feel the result, its only a matter of time. They will asset/value strip for all they are worth, as long as they can...

Login or register to post comments

Sat, 09/24/2011 - 19:09 |

Ag Star

Ag Star

They'll pay if we make them pay. Like the French did with the guillotine. " When people lose everything and have nothing left to lose--THEY LOSE IT"...Gerald Celente These people mus be identified and hunted down and made examples--like King Luis and his BFF Marie in addition to thousand of "aristocrats" like Buffet, Bernanke, Paulson.

Login or register to post comments

Sun, 09/25/2011 - 00:39 |

RockyRacoon

RockyRacoon

I'm a generous person. I'd settle for all the sonsabitches to be flat broke living in a cardboard box under the nearest overpass. Just so long as we get to pass by velvet rope reception lines and watch them suffer.

Login or register to post comments

Sat, 09/24/2011 - 17:03 |

Stoploss

Stoploss

More like to big to survive..

Login or register to post comments

Sat, 09/24/2011 - 08:14 |

Oh regional Indian

Oh regional Indian

Financial Engineering and Financial innovation, madness!

Once re-insurance became a fad, there was only one way to go, Downhill. Because even the thinnest tail could only be sliced in so many ways. And the farther you reached into it, the more unstable the re-re-re-re-re-re insurance pyramid structure became.

And now, with 6 sigma firmly in the Rear view mirror, all of this risk pyramid money making nonssense will finally crash. I see it like a rubber band, snapping back to the new new normal.

Mourge on Stanley, mourge on.

ORI

Uppers and Downers

Login or register to post comments

Sat, 09/24/2011 - 08:48 |

trampstamp

trampstamp

Agreed. Everyone is coming over to ZeroHedge. I remember I use to visit a site called daytradingradio[.]com many months ago and used to quote ZH in their membership chat. Basically they were references to TD posts regarding how bad financially the globe was and to be prepared for a downturn. But these guys on there were full tard bullish and basically shrugged me off. The other day I just so happened to stop by to see how they were doing and I shit you not the main guy Dave was quoting ZH... Almost like an addiction he would go to ZH every few minutes to see what TD was pumping out. I just laughed. Just in case those shills are reading this... Glad you guys finally made it here.... - rander.

Login or register to post comments

Sat, 09/24/2011 - 09:59 |

citrine

citrine

They would say "some blogger"

Login or register to post comments

Sat, 09/24/2011 - 11:44 |

RSloane

RSloane

I have absolutely no doubt that a website with this amount of traffic and nature of the participants is read by politicians and their staff, as well as financial players.

Login or register to post comments

Sat, 09/24/2011 - 12:14 |

Prometheus418

Prometheus418

A good reason to post comments.

What, did you think "voting" was going to do anyone any good?

Login or register to post comments

Sat, 09/24/2011 - 17:38 |

Dingleberry

Dingleberry Voting just make one "feel" like they are part of the process. TPTB love that. Once folks get wise and realize they are NOTHING BUT PAWNS, and their supposed "team" of blue or red is primarily responsible to deliver their respective constituencies to whover pays them off with bribes (campaign contributions). Once folks stop voting, the jig will be up. And then TPTB will be very concerned, to say the least.

Login or register to post comments

Sat, 09/24/2011 - 13:47 |

newworldorder

newworldorder RE: RSloane

Not read by Obamer or the Congressional leadership. Too far below their pay grade to bother.

Login or register to post comments

Sat, 09/24/2011 - 09:13 |

Reggie Middleton

Reggie Middleton

Hey, there ain't no concentration risk in US banks, and any blogger with two synapses to spark together should know this...

An Independent Look into JP Morgan.

Cute graphic above, eh? There is plenty of this in the public preview. When considering the staggering level of derivatives employed by JPM, it is frightening to even consider the fact that the quality of JPM's derivative exposure is even worse than Bear Stearns and Lehman‘s derivative portfolio just prior to their fall. Total net derivative exposure rated below BBB and below for JP Morgan currently stands at 35.4% while the same stood at 17.0% for Bear Stearns (February 2008) and 9.2% for Lehman (May 2008). We all know what happened to Bear Stearns and Lehman Brothers, don't we??? I warned all about Bear Stearns (Is this the Breaking of the Bear?: On Sunday, 27 January 2008) and Lehman ("Is Lehman really a lemming in disguise?": On February 20th, 2008) months before their collapse by taking a close, unbiased look at their balance sheet. Both of these companies were rated investment grade at the time, just like "you know who". Now, I am not saying JPM is about to collapse, since it is one of the anointed ones chosen by the government and guaranteed not to fail - unlike Bear Stearns and Lehman Brothers, and it is (after all) investment grade rated. Who would you put your faith in, the big ratings agencies or your favorite blogger? Then again, if it acts like a duck, walks like a duck, and quacks like a duck, is it a chicken??? I'll leave the rest up for my readers to decide.

This public preview is the culmination of several investigative posts that I have made that have led me to look more closely into the big money center banks. It all started with a hunch that JPM wasn't marking their WaMu portfolio acquisition accurately to market prices (see Is JP Morgan Taking Realistic Marks on its WaMu Portfolio Purchase? Doubtful! ), which would very well have rendered them insolvent - particularly if that was the practice for the balance of their portfolio as well (see Re: JP Morgan, when I say insolvent, I really mean insolvent). I then posted the following series, which eventually led to me finally breaking down and performing a full forensic analysis of JP Morgan, instead of piece-mealing it with anecdotal analysis.

The Fed Believes Secrecy is in Our Best Interests. Here are Some of the Secrets

Why Doesn't the Media Take a Truly Independent, Unbiased Look at the Big Banks in the US?

As the markets climb on top of one big, incestuous pool of concentrated risk...

Any objective review shows that the big banks are simply too big for the safety of this country

Why hasn't anybody questioned those rosy stress test results now that the facts have played out?

You can download the public preview here. If you find it to be of interest or insightful, feel free to distribute it (intact) as you wish.

Login or register to post comments

Sat, 09/24/2011 - 09:42 |

Reggie Middleton

Reggie Middleton

...Wrong. The problem with bilateral netting is that it is based on one massively flawed assumption, namely that in an orderly collapse all derivative contracts will be honored by the issuing bank (in this case the company that has sold the protection, and which the buyer of protection hopes will offset the protection it in turn has sold). The best example of how the flaw behind bilateral netting almost destroyed the system is AIG: the insurance company was hours away from making trillions of derivative contracts worthless if it were to implode, leaving all those who had bought protection from the firm worthless, a contingency only Goldman hedged by buying protection on AIG. And while the argument can further be extended that in bankruptcy a perfectly netted bankrupt entity would make someone else who on claims they have written, this is not true, as the bankrupt estate will pursue 100 cent recovery on its claims even under Chapter 11, while claims the estate had written end up as General Unsecured Claims which as Lehman has demonstrated will collect 20 cents on the dollar if they are lucky.

The point of this detour being that if any of these four banks fails, the repercussions would be disastrous. And no, Frank Dodd's bank "resolution" provision would do absolutely nothing to prevent an epic systemic collapse.

Super, Duper, B-I-N-G-0!!! It is so relieving to hear someone else espouse what really should be common damn sense, yet happens to be one of the uncommon commodities to be found on the Isle of Manhattan.

Login or register to post comments

Sat, 09/24/2011 - 10:20 |

spiral_eyes

spiral_eyes Word, Reggie.

Here on Zero Hedge we appreciate what you do.

Login or register to post comments

Sat, 09/24/2011 - 11:37 |

nope-1004

nope-1004

Here here!

Thanks Reggie.

Login or register to post comments

Sat, 09/24/2011 - 14:15 |

P Rankmug

P Rankmug

Any problems discussed above have already been taken care of under the National Security umbrella. What this means, if institutions like J.P. Morgan are deemed to be integral to U.S. National Security - they could be "legally" excused from reporting their true financial condition.

Intelligence Czar Can Waive SEC Rules,

"President George W. Bush has bestowed on his [then] intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006, that was opaque to the untrained eye."

http://www.businessweek.com/bwdaily/dnflash/may2006/nf20060523_2210.htm?...

Login or register to post comments

Sun, 09/25/2011 - 05:58 |

jeff montanye

jeff montanye thank you. nice to see five year old news that is still unknown, at least to me. they just never quit do they?

Login or register to post comments

Sat, 09/24/2011 - 13:38 |

Hulk

Hulk

Great Job Reggie. I always figured bi lateral netting was a croc of shit based on the AIG experience. I thank you for the education you and zh have afforded me...

Login or register to post comments

Sat, 09/24/2011 - 16:04 |

FinalCollapse

FinalCollapse Reggie - it is high time for you to learn a difference between trillion and billion. If you still don't get it - then please return to the Elementary school to take some math classes. This is third time I see this factual error presented by you.

Please kindly read your own presentation, looking for the word 'billion'. See - it does not make sense. The chart that you borrowed has unit of million.

I like your presentations, but you have no shame to repeat the same errors. These are facts - you confuse billions with trillions, and you do repeatedly. I feel sorry for the folks who pay for your advice.

Do you still have problem understanding your errros - please contact me offline, and I can explain it to you.

80,000,000 millions is 80 trillions, not 80 billions.

Login or register to post comments

Sun, 09/25/2011 - 06:06 |

jeff montanye

jeff montanye thanks, good point. the main graph about jpm gross derivatives exposure vs. world gnp is really far more disturbing than reggie's description of it. but like his difficulty with imperfect verbs (have went) it doesn't really undercut his conclusions, though it does make him less acceptable in the mainstream world.

Login or register to post comments

Sat, 09/24/2011 - 09:32 |

Reggie Middleton

Reggie Middleton

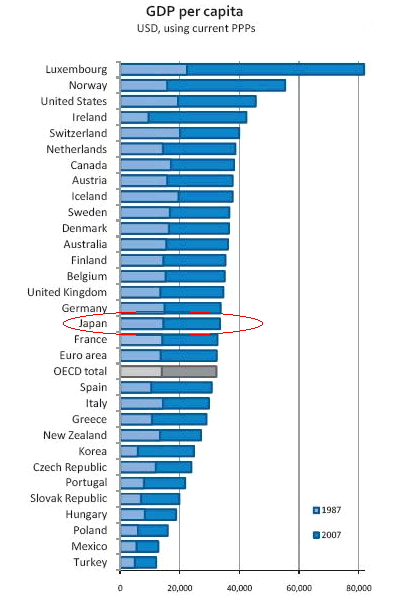

Oh yeah, and while we're at it, this Morgan Stanley thing has been a concern of mine for well over a year now. The interest rate storm is coming, that is unless Europe can maintain historically low rates as several countries default. Then again, they never default, right...

Don't belive me, let's look at history...

So, as I was saying...

Check this out, from "On Morgan Stanley's Latest Quarterly Earnings - More Than Meets the Eye???" Monday, 24 May 2010:

Those who don't subscribe should reference my warnings of the concentration and reliance on FICC revenues (foreign exchange, currencies, and fixed income trading). Morgan Stanley's exposure to this as well as what I have illustrated in full detail via the the Pan-European Sovereign Debt Crisis series, has increased materially. As excerpted from "The Next Step in the Bank Implosion Cycle???":

The amount of bubbliciousness, overvaluation and risk in the market is outrageous, particularly considering the fact that we haven't even come close to deflating the bubble from earlier this year and last year! Even more alarming is some of the largest banks in the world, and some of the most respected (and disrespected) banks are heavily leveraged into this trade one way or the other. The alleged swap hedges that these guys allegedly have will be put to the test, and put to the test relatively soon. As I have alleged in previous posts (As the markets climb on top of one big, incestuous pool of concentrated risk... ), you cannot truly hedge multi-billion risks in a closed circle of only 4 counterparties, all of whom are in the same businesses taking the same risks.

Click to expand!

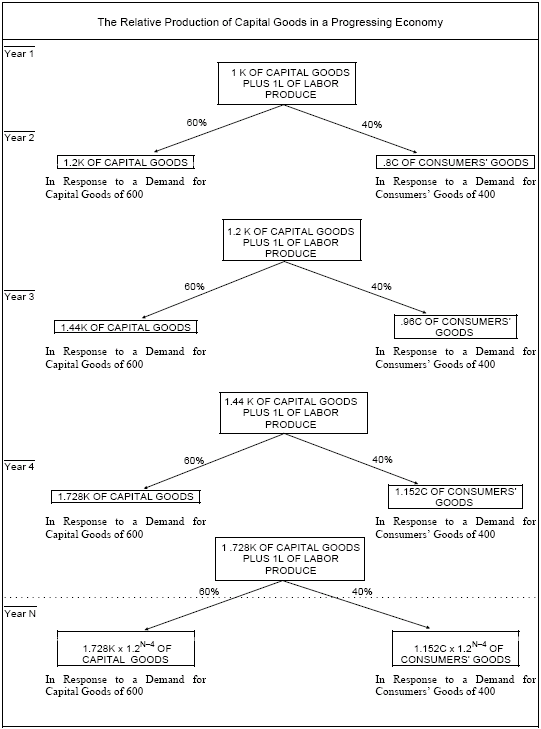

So, How are Banks Entangled in the Mother of All Carry Trades?

Trading revenues for U.S Commercial banks have witnessed robust growth since 4Q08 on back of higher (although of late declining) bid-ask spreads and fewer write-downs on investment portfolios. According to the Office of the Comptroller of the Currency, commercial banks' reported trading revenues rose to a record $5.2 bn in 2Q09, which is extreme (to say the least) compared to $1.6 bn in 2Q08 and average of $802 mn in past 8 quarters.

High dependency on Forex and interest rate contracts

Continued growth in trading revenues on back of growth in overall derivative contracts, (especially for interest rate and foreign exchange contracts) has raised doubt on the sustainability of revenues over hear at the BoomBustBlog analyst lab. According to the Office of the Comptroller of the Currency, notional amount of derivatives contracts of U.S Commercial banks grew at a CAGR of 20.5% to $203 trillion by 2Q-09 from $87.9 trillion in 2004 with interest rate contracts and foreign exchange contracts comprising a substantial 84.5% and 7.5% of total notional value of derivatives, respectively. Interest rate contracts have grown at a CAGR of 20.1% to $171.9 trillion between 4Q-04 to 2Q-09 while Forex contracts have grown at a CAGR of 13.4% to $15.2 trillion between 4Q-04 to 2Q-09.

In terms of absolute dollar exposure, JP Morgan has the largest exposure towards both Interest rate and Forex contracts with notional value of interest rate contracts at $64.6 trillion and Forex contracts at $6.2 trillion exposing itself to volatile changes in both interest rates and currency movements (non-subscribers should reference An Independent Look into JP Morgan, while subscribers should reference

As a result of a surge in interest rate and Forex contracts, dependency on revenues from these products has increased substantially and has in turn been a source of considerable volatility to total revenues. As of 2Q-09 combined trading revenues (cash and off balance sheet exposure) from Interest rate and Forex for JP Morgan stood at $2.4 trillion, or 9.5% of the total revenues while the same for GS and BAC (subscribers, see

Although JP Morgan's exposure to interest rate contracts has declined to $64.5 trillion as of 2Q09 from $75.2 trillion as of 3Q07, trading revenues from Interest rate contracts (cash and off balance sheet position) have witnessed a significant volatility spike and have increased marginally to $1,512 in 2Q09 compared with $1,496 in 3Q07. Although JPM's Forex exposure has decreased from its peak of $8.2 trillion in 3Q08, at $3.2 trillion in 2Q09 the exposure is still is higher than 3Q07 levels. Even for Bank of America and Citi , the revenues from Interest rate and forex products have been volatile despite a moderate reduction in overall exposure. With top 5 banks having about 97% market share of the total banking industry notional amounts as of June 30, 2009, the revenues from trading activities for these banks are practically guaranteed to be highly volatile in the event of significant market disruption - a disruption aptly described by the esteemed Professor Roubini as a rush to the exit in the "Mother of All Carry Trades" as the largest macro experiment in the history of this country starts to unwind, or even if the participants in this carry trade think it is about to start to unwind.

The table below shows the trend in trading revenues from Interest rate and Forex positions for top banks in U.S.

Click to enlarge...

Banks exposure to interest rate and foreign exchange contracts

With volatility in currency markets exploding to astounding levels (with average EUR-USD volatility of 16.5% over the past year (September 2008-09) compared to 8.9% over the previous year), commercial and investment banks trading revenues are expected to remain highly unpredictable. This, coupled with huge Forex and Interest rate derivative exposure for major commercial banks, could trigger a wave of losses in the event of significant market disruptions - or a race to the exit door of this speculative carry trade. Additionally most of these Forex and Interest rate contracts are over-the-contract (OTC) contracts with 96.2% of total derivative contracts being traded as OTC. This means no central clearing, no standardization in contracts, the potential for extreme opacity in pricing, diversity in valuation as well as a dearth of liquidity when it is most needed - at the time when everyone is looking to exit. Goldman Sachs has the largest OTC traded contracts with 98.5% of its derivative contracts traded over the counter. With the 5 largest banks representing 97% of the total banking industry notional amount of derivatives and most of these contracts being traded off exchange, the effectiveness of derivatives as a hedging instrument raises serious questions since most of these banks are counterparty to one another in one very small, very tight circle (see the free article, "As the markets climb on top of one big, incestuous pool of concentrated risk... ").

The table below compares interest rate contracts and foreign exchange contracts for JPM, GS, Citi, BAC and WFC.

JP Morgan has the largest exposure in terms of notional value with $64,604 trillion of notional value of interest rate contracts and $6,977 trillion of notional value of foreign exchange contracts. In terms of actual risk exposure measured by gross derivative exposure before netting of counterparties, JP Morgan with $1,798 bn of gross derivative receivable, or 21.7x of tangible equity, has the largest gross derivative risk exposure followed by Bank of America ($1,760 bn, or 18.1x). Bank of America with $1,393 bn of gross derivatives relating to interest rate has the highest exposure towards interest rate sensitivity while JP Morgan with $154 bn of Foreign exchange contracts has the highest exposure from currency volatility. We have explored this in forensic detail for subscribers, and have offered a free preview for visitors to the blog: (

Subscribers, see

Subscribers, see

Login or register to post comments

Sat, 09/24/2011 - 09:55 |

disabledvet

disabledvet

"Even at a penny Lehman still trades." Move along.

Login or register to post comments

Sat, 09/24/2011 - 11:54 |

gmrpeabody

gmrpeabody

Yes.., but what does it all mean, Reggie?

Login or register to post comments

Sat, 09/24/2011 - 13:06 |

Kayman

Kayman

gmrpeabody

" you cannot truly hedge multi-billion risks in a closed circle of only 4 counterparties, all of whom are in the same businesses taking the same risks"

Summary for you...

Login or register to post comments

Sat, 09/24/2011 - 13:34 |

slewie the pi-rat

slewie the pi-rat

duh

but hadn't tyler already intimated that point? reggie is trolling & needs to keep his reasearch papers "above the line" where we can ignore him and not have him interfere with luddites and people w/ slower download situ's who want to read the blogs w/out having their systems jam due to r.m.'s head being terminally impacted

Login or register to post comments

Sat, 09/24/2011 - 20:23 |

Kayman

Kayman

Hi Slewie the pie-rat, of the 230 IQ, self-measured of course.

Login or register to post comments

Sun, 09/25/2011 - 06:11 |

jeff montanye

jeff montanye and, as per above, isn't the risk multi trillion (a trillion here, a trillion there and soon we are talking real money)?

Login or register to post comments

Sun, 09/25/2011 - 06:44 |

merizobeach

merizobeach

I thought we were talking about trillions of dollars of derivatives, not billions. There are plenty of multi-billion dollar private equity groups. Reggie's original graph contains a glaring typo, as does the line you quote.

Login or register to post comments

Sat, 09/24/2011 - 10:14 |

wannabe traitor

wannabe traitor

much appreciated!

Login or register to post comments

Sat, 09/24/2011 - 10:14 |

TulsaTime

TulsaTime Gee Reggie, nice of you to import the blog into ZH comments. A link would have worked fine, since we all know that you have a blog with a subscriber level. Could you try to tone down the me me meism? It makes reading the data (which is great) like suffering through a car dealership ad.

Just sayin.....

Login or register to post comments

Sat, 09/24/2011 - 11:07 |

Mr Lennon Hendrix

Mr Lennon Hendrix

Why are you telling him how to act? Let his lady friends do that. Unless of course you are his lady friend, then my apologies. Would love to have you and Reggie over some time.

Login or register to post comments

Sat, 09/24/2011 - 11:55 |

gmrpeabody

gmrpeabody

Well played.

ROTFLMAO!

Login or register to post comments

Sat, 09/24/2011 - 12:00 |

JLee2027

JLee2027

LOL

Login or register to post comments

Sat, 09/24/2011 - 11:28 |

spankthebernank

spankthebernank Sometimes lazy people don't click on links and you should only be ecstatic that a guy like Reggie shares his knowledge and research with you. The man clearly loves what he does and gets to the heart of the most important issues. We should know that he has been spot on for quites some time now, so I and me is required in relaying that message.

Login or register to post comments

Sat, 09/24/2011 - 11:41 |

nope-1004

nope-1004

+1

Login or register to post comments

Sun, 09/25/2011 - 01:22 |

Ponzi Unit

Ponzi Unit

Tulsa, go buy a dumb looking Pontiac somewhere.

Login or register to post comments

Sat, 09/24/2011 - 10:30 |

SilverRhino

SilverRhino

The US has never defaulted? How about 1933 and 1971?

Login or register to post comments

Sat, 09/24/2011 - 10:56 |

Marco

Marco The whole world followed in both cases though ... and the whole world will follow the next time too.

Login or register to post comments

Sat, 09/24/2011 - 11:10 |

Mr Lennon Hendrix

Mr Lennon Hendrix

I like to think of the past 4 years as a quasi default. Issuing debt that is unpayable is the last act of a State, and should be seen as the ultimate default.

Login or register to post comments

Sat, 09/24/2011 - 11:29 |

NidStyles

NidStyles We are defaulting every day we are in debt.

Login or register to post comments

Sat, 09/24/2011 - 11:52 |

donsluck

donsluck

Huh?

Login or register to post comments

Sat, 09/24/2011 - 11:56 |

Oh regional Indian

Oh regional Indian

I think it's exponential growth in debt and negative velocity of money he is referring to.

ORI

Login or register to post comments

Sat, 09/24/2011 - 13:09 |

Kayman

Kayman

Uhhh... the South defaulted....

Login or register to post comments

Sat, 09/24/2011 - 13:11 |

bankruptcylawyer

bankruptcylawyer reggie i'm starting to think you are a CIA plant. because you are a little TOO good.

and by the way, i love your pronunciation of the word malaise as 'malaysia'.

seirously i'm not making fun of you, i pronounce words differently on purpose all the time because i like too. i think the idiots out there are not the people who dont know the 'correct' pronunciation, but the fools who think they are 'correcting' mine. anyway, malaysia sounds good, but to me, it's contradictory in nature as i have always associate malaysia with a pleasant and good feeling as an island nation with spicy food, and that doesn't jive with 'malaise'. which makes it pretty neat in a way---i like juxtaposition of content/tone/meaning. always makes words more interesting. even if you didnt' mean to do it, still, pretty cool.

Login or register to post comments

Sun, 09/25/2011 - 06:16 |

jeff montanye

jeff montanye and because "jibe" doesn't capture the bouncy beat of the music that goes with the spicy food.

Login or register to post comments

Sat, 09/24/2011 - 13:36 |

JW n FL

JW n FL

Oldie but goodie Reggie.. enjoy!

http://www.youtube.com/watch?v=g_U_lV2WyDs&feature=

Music.. if you dont like my taste in music.. dont listen or bitch like a woman about it..

if it's too loud you are too old!

Login or register to post comments

Sat, 09/24/2011 - 13:58 |

newworldorder

newworldorder Reggie,

I have often wondered, if TBTF is a concept applied to derivatives, - why have all the regulatory agencies, Congress and President Obama ingnored this timebomb. If anything screams of national security if this goes off, one would want to fix this first.

What am I missing here? Can it be as simple as perpetual greed by the five largest banks or is it the inability by politicians to grasp the imperatives of taking action?

Login or register to post comments

Sat, 09/24/2011 - 10:56 |

treasurefish

treasurefish Please sign the petition to END THE FED!

http://wh.gov/gMx

Login or register to post comments

Sat, 09/24/2011 - 19:55 |

KingdomKum

KingdomKum

signing this petition puts you on the top of the FEMA camp list - no one in their right mind should sign anything having to do with the WH - unless you'd like a visit from the FBI. CIA, etc.

Login or register to post comments

Sat, 09/24/2011 - 06:38 |

Fips_OnTheSpot

Fips_OnTheSpot

Last sheet is almost unreadable, could you add a zoomed version? (EDIT: just "view image", it just not linked)

Anyway, frightening for paper sheeples.

Login or register to post comments

Sat, 09/24/2011 - 06:43 |

solgundy

solgundy http://www.occ.gov/topics/capital-markets/financial-markets/trading/deri...

Login or register to post comments

Sat, 09/24/2011 - 06:52 |

Fips_OnTheSpot

Fips_OnTheSpot

Danke - and now the sheet is linked +1

Login or register to post comments

Sat, 09/24/2011 - 08:49 |

smlbizman

smlbizman

ot, but what is going on with the lbma...are they going under or being bought or other trouble?

Login or register to post comments

Sat, 09/24/2011 - 11:13 |

Mr Lennon Hendrix

Mr Lennon Hendrix

While we are here, I hope everyone visits their coin shop today to buy some silver, gold, or platinum. In the game of musical chairs, you never know when the music is going to stop!

Sprott Money Temporarily Runs Out of Physical Silver:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/9/23_Sp...

Login or register to post comments

Sat, 09/24/2011 - 11:21 |

Mr Lennon Hendrix

Mr Lennon Hendrix

We also have a new dog in the fight. Gentleman Gerald Celente has joined our war, and is buying silver. Interestingly, he is using the same logic that I did one and a half years ago when I thought that the "governments" would try and confinscate gold but not silver.

Gerald Celente Announces He’s Buying Silver:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/9/23_KW...

Login or register to post comments

Sat, 09/24/2011 - 11:32 |

NidStyles

NidStyles I thought he had been a while back but sold to go all in on Gold. I remember him saying something like that in the past.

Login or register to post comments

Sat, 09/24/2011 - 11:57 |

Mr Lennon Hendrix

Mr Lennon Hendrix

At first he kept half of his wealth in gold, and the other half in fiat split between dollars and Euros. Then he sold the Euros for Loonies. Then he sold the Loonies for Swiss Francs. Then he sold his Swiss Francs. He may have traded the capital from the Francs for the silver, which would mean he is 50% gold, 25% dollars, and 25% silver. If he is wary about gold, he may have traded some of that in too. But this does appear to be his first move into silver.

Login or register to post comments

Sat, 09/24/2011 - 13:37 |

JW n FL

JW n FL

2 of my Favorite People!

Max! and Bill!! all in one spot!

http://www.youtube.com/watch?v=wWRb38fE3S8

Uploaded by GJT771 on Sep 20, 2011

20/09/2011

Max Keiser & Stacy Herbert discuss Babyface Bernanke, Eurotarp and 'rogue traders.' In the 2nd half of the show, Max talks to Bill Still, director of The Money Masters & The Secret of Oz, about Fort Knox, state banks and monetary reform.

Login or register to post comments

Sat, 09/24/2011 - 06:38 |

hondamikesd

hondamikesd

Glad to see the cockroaches at Morgan the lesser finally getting some light shined on them.

Login or register to post comments

Sat, 09/24/2011 - 06:41 |

Sambo

Sambo

How long is the fuse on that Time bomb? 24 hrs? and has it been lit?

Login or register to post comments

Sat, 09/24/2011 - 09:58 |

disabledvet

disabledvet

and how will they play it? Hit it boyz!

http://www.youtube.com/watch?v=k55NuWQCh78&feature=player_detailpage

Login or register to post comments

Sat, 09/24/2011 - 11:39 |

Sambo

Sambo

ssssssssssssssssssssssss.....sss..ss.....boooooooooooooooooooooooooooooooooooooooooom

Login or register to post comments

Sat, 09/24/2011 - 06:46 |

Ghordius

Ghordius

For all purposes, the 4/25 are a cartel. Individual banker can even in all honesty believe in cut-throat-competition, and perhaps it was all an accident.

For all purposes, the derivateves BIND the 4/25 with CHAINS of prices and trades which is what so many experience as PLANNING.

There are laws against cartels, and they don't even care if there is an intent - "do you agree on what you trade" -> "yes, our DERIVATIVES dictate our behaviour - or we go bust"

I will never tire to write that most derivatives, like CDS, are a form of INSURANCE of the IMMORAL kind - we have found this out in the world of "normal" insurance that it's UNHEALTHY for an insurer to allow people to insure their neighbours' houses, the street and the insurer eventually go up in flames.

Break the cartel, save the sorry bastards from themselves. Separate commercial banking from investment banking. Set employee headcount, balance sheet, services and territorial limitations on all banks.

Login or register to post comments

Sat, 09/24/2011 - 06:48 |

Fips_OnTheSpot

Fips_OnTheSpot

Word! But I think it wont happen - at least not before this whole thing goes up in one big BOOOOM.

Login or register to post comments

Sat, 09/24/2011 - 10:00 |

disabledvet

disabledvet

HOW ABOUT FREE CHECKING THOUGH?

Login or register to post comments

Sun, 09/25/2011 - 01:08 |

RockyRacoon

RockyRacoon

I never did get my toaster...

Login or register to post comments

Sat, 09/24/2011 - 10:52 |

DeadFred

DeadFred

But they can't do that or they might lose some money.

Login or register to post comments

Sat, 09/24/2011 - 06:46 |

nmewn

nmewn

Good thing AIG was re-capitalized, oh wait...what was that number again? ;-)

Login or register to post comments

Sat, 09/24/2011 - 06:55 |

Ghordius

Ghordius

;-) recently it dawned to me that buying them (their market cap) is in the ballpark of 100x to 1000x less than their exposures.

when the European govs realize this they might buy and nationalize their TBTF banks, which is the same as taking a live granade off the hand of a child by buying it with a lollipop. A bargain.

Login or register to post comments

Sat, 09/24/2011 - 07:01 |

nmewn

nmewn

No doubt a bargain for the "dear innocent child".

Not so much for the future value of EU lollipops ;-)

Login or register to post comments

Sat, 09/24/2011 - 09:12 |

LeBalance

LeBalance

Who are the EU govs beholden to and what was their strategy from the get-go? They Own the Game!

Login or register to post comments

Sat, 09/24/2011 - 11:18 |

Mr Lennon Hendrix

Mr Lennon Hendrix

They are beholden to Mordor and their strategy is to feed the population poison laced lolies.

Login or register to post comments

Sat, 09/24/2011 - 06:51 |

Racer

Racer

They just didn't learn any lessons did they! Allowing them to get even bigger and allowing them to build an even bigger bomb!

Login or register to post comments

Sat, 09/24/2011 - 08:31 |

oogs66

oogs66 truly insane....force unwinds/assignments to collapse the gross notionals and force as much onto clearing/exchanges as possible

this should have been fixed after Lehman (actually after Bear)

total failure of government and regulators....Fed should be spending more time on this and less time on QE

Login or register to post comments

Sat, 09/24/2011 - 06:58 |

MichaelG

MichaelG

$23trn chump change now? (9.2% of $250trn.) Even with a (near oxymoronic) "orderly collapse," I'm not sure even Ben has sufficient printer ink.

Login or register to post comments

Sat, 09/24/2011 - 06:53 |

johnQpublic

johnQpublic not to big to fail, more like ripe to fail

any reason derivatives are legal?

in what way are they a function of banking?

and not of gambling?

just declare all derivatives null and void, bing, problem solved

switch over to insuring poker hands instead...at least that could be monitored with little cameras like on the WSOP

Sat, 09/24/2011 - 06:53 |

johnQpublic

johnQpublic not to big to fail, more like ripe to fail

any reason derivatives are legal?

in what way are they a function of banking?

and not of gambling?

just declare all derivatives null and void, bing, problem solved

switch over to insuring poker hands instead...at least that could be monitored with little cameras like on the WSOP

Login or register to post comments

Sat, 09/24/2011 - 07:14 |

hondamikesd

hondamikesd

Not to say that derivitaves haven't gone completely off the fucking rails lately but SOME of them have a purpose.

It's probably pretty nice as a farmer to have a selling price locked in via futures when you put seed into the ground as opposed to depending on the manic-depression we've seen in the markets lately. Or as an airline to know you'll be able to operate at a certain price by locking in fuel via futures. Some predictability and price stability is to be desired (try telling that to the Chairsatan...)

Still, can't argue that the process has gotten insane when we're looking at double digit multiples of GDP tied up in them by the four crime families, err, *cough*, banks.

Not everything on the fucking planet needs to be "financialized".

Login or register to post comments

Sat, 09/24/2011 - 08:50 |

snowball777

snowball777

Two huge differences...those derivatives are a function of something to which the buyer has exposure and would not fret about having on an exchange.

Login or register to post comments

Sat, 09/24/2011 - 07:17 |

o2sd

o2sd

any reason derivatives are legal?

Same reason insurance is legal.

in what way are they a function of banking?

They enable financing of lower credit rated counterparties.

and not of gambling?

They are most definitely not gambling. They allow you to take a position on any market movement.

just declare all derivatives null and void, bing, problem solved

Except for the fact that credit markets would dry up. Capital seeks to maximise returns while managing risks. If there is no way to manage risk, capital is witheld. The problem with derivitaves lies with systemic risk, which is a function of opacity in OTC markets.

Login or register to post comments

Sat, 09/24/2011 - 07:57 |

Watson

Watson Insurance is generally legal, but not totally.

For example: Not legal in most jurisdictions to buy fire insurance on property you do not own (or have a positive interest in).

This is not true of CDS, and it is not a healthy situation.

Login or register to post comments

Sat, 09/24/2011 - 08:06 |

o2sd

o2sd

For example: Not legal in most jurisdictions to buy fire insurance on property you do not own (or have a positive interest in).

Because, if you burnt it down to collect the insurance, you would never be charged with arson or insurance fraud?

This is not true of CDS, and it is not a healthy situation.

Once upon a time, the ratings companies told you what they thought the probability of default was for a given issuer (sovereign or corporate). THAT turned out to be unhealthy, because of the conflict of interest. Now with CDS markets, the MARKET tells you what they think is the probability of default.

If you want to get rid of CDS, then I have some Moodys & S&P AAA rated Collateralised Debt Obligations to sell you. Interested?

Login or register to post comments

Sat, 09/24/2011 - 09:03 |

jm

jm

I agree with your point about what CDS are and how they work, and your point about lack of transparency. But the point of this article and the dissenters have is separate from this.

There is an organic purpose behind CDS. But the lack of transparency (among other things) has led to systematic exposures that create problems of scale that dwarf their benefit and involve people adversely that have no skin in the game. And there is a possibility of cascading failures again.

Yes, in an ideal world with ideal rules, market discipline, and info they would not pose these problems. But the world we have is not ideal, and those in charge of managing it created a vomitorium.

Of course, there is a sensible way out of this. Settle for pennies on the dollar. Then we'll see the true test of how useful these contract really are.

Login or register to post comments

Sat, 09/24/2011 - 09:56 |

o2sd

o2sd

If large numbers of people started dying from some disease, i.e. a pandemic, then it is unlikely that the response would be to start blaming life insurance. It would be considered a public health problem, not a failure of the insurance industry.

Likewise with financial markets. At the core of the problem is a sickness in capital allocation. Capital once flowed to productive industry, however for 20 years before the GFC, capital began flowing to fixed assets (primarily housing). Fixed assets don't produce anything. They don't grow in sales, they inspire no new technologies, they send no food to market.

Yes, it is foolish to believe that one can use complex mathematics to create insurance for what is ultimately complete and utter stupidity, but those derivatives serve other legitimate purposes in capital markets.

It is malinvestment and misallocation of capital that has destroyed derivative markets, not the other way around.

Login or register to post comments

Sat, 09/24/2011 - 10:37 |

jm

jm

CDS are not the core problem. The core problem is bank balance sheets so impaired that it makes them insolvent. One insolvency leads to a cascading of defaults. CDS are just an instrument that contributes to this problem in a very specific way. They allow credit risk to be concentrated in a few entities that makes them insolvent, leading to the cascade. It is true that central clearing would make alleviate this, because you wouldn't contract with a counterparty with concentrated risk. But that is not where we are.

The reality is that CDS allow a party to assume risk exposures that no regulator would permit if he understood/was uncorrupted. Central bank balance sheet expansion has compressed spreads, altering the price of credit risk. There is an implicit backstop mentality that may nor may not be real, but I'm pretty sure it impacts the price of credit risk. Also, there is a kick-the-can-down-the-road incentive: a CDS dealer gets his commission up front and he doesn't care about what happens to the bank, b/c he is after his FU money. This is exactly how the clowns in government act.

I agree with just about everything you say. I won't even get started with the modelling problems. I'm just saying we need to think about where we are and how to get where we should be in the use of these contracts. Not get rid of them.

Login or register to post comments

Sat, 09/24/2011 - 11:20 |

disabledvet

disabledvet

this is very good. i will add the same two cents i always do here. "the government is the counter-party now." The United States did this INSTANTANEOUSLY. Europe is only waking up to this fact--and about two years too late it would seem. That's why it's easy for me to say "i give the European Union one week before it implodes." Not saying that's what in actuality going to happen--but when the German President is willing to "use the military" to protect trade routes the question of course is "where are the trade flows to begin with Mein Fuher?" I find it simply unfathomable that the European Community can't see this. Every state in the monetary union is competing separately with China? Answer? Gold, gold, gold, gold, gold. THE ONLY ANSWER.

Login or register to post comments

Sat, 09/24/2011 - 18:42 |

o2sd

o2sd

I agree with everything you say. Here is where you get fuzzy:

The core problem is bank balance sheets so impaired that it makes them insolvent. One insolvency leads to a cascading of defaults.

I'm saying that bank balance sheets are impaired by housing and the underlying theory behind the movement of capital into consumer mortgages over the last 30 years (accelerating in the period from 1994-2004). The entire lending book has changed structure.

The theory behind this is that consumers with mortgages are motivated to create wealth to pay off their mortgage. What is not clear is how consumers can create wealth working for the state or the corporatocracy.

If they want to be entrepreneurial and create some kind of business, they will need access to risk capital, something that is in short supply, because of the desire of those who control capital for risk free returns. Risk aversity has driven capital into unproductive investments, changing the risk to a systemic risk along the way.

Login or register to post comments

Sat, 09/24/2011 - 13:37 |

Kayman

Kayman

o2sd

"Fixed assets don't produce anything. They don't grow in sales, they inspire no new technologies, they send no food to market."

Now hold on there Sparky, I guess I will stop investing in plant and equipment, and put all my money into the TrickFuck PattyCake paper game.

Would you care to review that sloppy comment ? You can't sucker punch at Fight Club.

Login or register to post comments

Sat, 09/24/2011 - 18:14 |

o2sd

o2sd

Would you care to review that sloppy comment ?

Sure. Consumers don't purchase plant and equipment.

Why is it that in the last 30 years, the makeup of bank lending books has gone from 30% mortgages to more than 70%? Not much plant and equipment being purchased there.

Login or register to post comments

Sat, 09/24/2011 - 18:12 |

snowball777

snowball777

And if all their policies paid out to the same person who was caught with a bottle of arsenic?

Login or register to post comments

Sat, 09/24/2011 - 18:44 |

o2sd

o2sd

And the person with the bottle of arsenic turned out to be The President of the United States????

Login or register to post comments

Sat, 09/24/2011 - 13:29 |

Kayman

Kayman

If Banksters had to hold reserves (like Insurance Companies are required by law) the current opaque Derivatives market would shrink like a prune, it would no longer be infinitely profitable, and the general public would not be assigned the bill for default at the point of a gun.

By the way, can I put some insurance on your house ? I promise not to burn it down.

Login or register to post comments

Sat, 09/24/2011 - 08:32 |

oogs66

oogs66 then options should go away too

Login or register to post comments

Sat, 09/24/2011 - 09:02 |

rwe2late

rwe2late

o2sd

Same reason insurance is legal.

Insurance (including derivative insurance) is a form of gambling. With life insurance for example, you are betting you will die, the insurance company is betting you will live.

They enable financing of lower credit rated counterparties.

Isn't that part of the problem, the financing of even "no credit" rated counterparties?

They allow you to take a position on any market movement... Capital seeks to maximize returns while managing risks. If there is no way to manage risk, capital is withheld. The problem with derivatives lies with systemic risk, which is a function of opacity in OTC markets.

Including positions with no stake (like taking out life insurance for a stranger). Insurance reduces the risk of moral hazard for the insured. But derivative insurance reduces the risk of moral hazard for the insurer, and all hell then breaks loose.

The problem is indeed systemic, but it is NOT a function of opacity. Opacity is intrinsic to the distance of counterparties with derivative “insurance“ (gambling).

Login or register to post comments

Sat, 09/24/2011 - 10:00 |

o2sd

o2sd

Isn't that part of the problem, the financing of even "no credit" rated counterparties?

Absolutely! But even more problematic is what those "no credit" rated counterparties use that capital for: housing. A house makes no products (except maybe children), produces no food for market, requires no technological innovation. It just sits there and keeps out the weather. Surely something so unproductive should take as little capital from the total supply as possible.

Insurance (including derivative insurance) is a form of gambling. With life insurance for example, you are betting you will die, the insurance company is betting you will live.

Perhaps, but just because I am betting I will die does not mean I want to die. There is however a RISK that I could die before the life tables say I will (on average). If I did, then the burden of my death would fall on those who lived LONGER than the life tables said they would (on average). We (as a society) or a group have distributed the risk amoungst ourselves.

Including positions with no stake (like taking out life insurance for a stranger)

True, however those who have no stake (speculators) are generally considered to add liquidity to these markets. They also allow losses to be spread over a larger number of participants.

The problem is indeed systemic, but it is NOT a function of opacity. Opacity is intrinsic to the distance of counterparties with derivative “insurance“ (gambling).

The RISK is a systemic risk. Derivatives that a 90% netted will always have a 10% downside unless the entire system collapses (hence the point of the original article). But there is nothing in the original article that points to the fracture point for systemic failure. The only hint is that Morgan Stanley is heavily exposed to FX risk, but there is no further information on the form that exposure takes.

IMO, opacity is the problem, because without transparency toxic exposures can fester to the point of no return (like Barings and Lehman).

Login or register to post comments

Sat, 09/24/2011 - 13:51 |

Kayman

Kayman

o2sd

I don't know if you are a mollycoddled academic or a laissez-faire, fuck the neighbors, capitalist.

But since housing is "unproductive" why don't you and your family go sleep outside for a year and we shall see how productive you become.

Just because the Fed, through Greenspan and Bernanke fucked up Housing for the American Middle Class, does not make it any less productive.

Except for futures contracts that allow the direct buyer and seller to take a position, all other derivatives serve one primary purpose only- to generate fees for today for the contract originator and push the risk off into the future and onto someone else. That someone is the taxpayer.

Login or register to post comments

Sat, 09/24/2011 - 18:27 |

o2sd

o2sd

I don't know if you are a mollycoddled academic or a laissez-faire, fuck the neighbors, capitalist.

Neither. Have another two ad-hominem attacks gratis in your next post though.

But since housing is "unproductive" why don't you and your family go sleep outside for a year and we shall see how productive you become.

Sure. I live in the tropics, so even a decent tent will suffice. HOWEVER, your statement confuses utility with productivity. A house is usefull, but not productive. It's usefullness stays fairly constant over time, and so it's capital allocation should do likewise. If the house is productive on the other hand, then it's capital allocation can increase without a nett loss in capital. Most houses are unproductive, and more to the point, the materials that were used in their construction are degrading, requiring maintenance and upkeep (further capital). In other words, most housing stock is a liability, a drain on capital. For a liability to go UP in price is an absurdity, and the source of most absurdities is government.

Just because the Fed, through Greenspan and Bernanke fucked up Housing for the American Middle Class, does not make it any less productive.

I would like to hear why you think housing is productive.

Except for futures contracts blah blah blah

The purpose of all derivative contracts is to spread risk over a larger number of participants. To dilute it, if you will. However, some risks are just to big to dilute, like socialist vote programs, or monumental stupidity.

Login or register to post comments

Sat, 09/24/2011 - 20:30 |

Kayman

Kayman

Productivity, is output over input. Without adequate housing, productivity, directly or indirectly, will decline.

If you wish to argue over how many angels can dance on the head of a pin, call the Pope to mediate.

Login or register to post comments

Sat, 09/24/2011 - 09:16 |

LeBalance

LeBalance

just check how much "real" capital is required to "insure" against loss without "gambling." Gambling means that you are "sure" that a certain percentage of the risk will not go bad. In the cases that are presently insured the percentage is higher than threshold and it was understood to be that way from day 1. Tick....tick.....tick....!!!

Login or register to post comments

Sat, 09/24/2011 - 09:26 |

NumberNone

NumberNone

So derivatives are basically the equivalent of me telling my friend that I will give him $1,000,000 if he makes a putt or wears a stupid shirt in public. It gets him to do something he doesn't want to do and I really have no intention of paying him.

At hundreds of trillions of dollars outstanding clearly the banks have no intention of ever settling their bets, but I guess it's worth the risk of someone calling your bluff if it gets them to do something they otherwise wouldn't do. And I'm sure there are some nice fees to made shuffling dollars back and forth on the transactions.

Login or register to post comments

Sat, 09/24/2011 - 10:06 |

o2sd

o2sd

So derivatives are basically the equivalent of me telling my friend that I will give him $1,000,000 if he makes a putt or wears a stupid shirt in public. It gets him to do something he doesn't want to do and I really have no intention of paying him.

Nope.

At hundreds of trillions of dollars outstanding clearly the banks have no intention of ever settling their bets,

That's the notional amount. At risk is probably between 500B and 3T. 500B is a scandal and a depression, 3T is a reset. You can probably guess which one they are aiming for.

And I'm sure there are some nice fees to made shuffling dollars back and forth on the transactions.

Liquidity has its price.

Login or register to post comments

Sat, 09/24/2011 - 12:05 |

NumberNone

NumberNone

Derivatives may have started as a nice way to share the risk but this is again an example of banks greed once again making their fucking problems our fucking problems. You may be correct in that the $250T is not the final number at the end of the day when the small circle-jerk of banks finish swapping their 'IOU's' the numbers are still so huge the system will collapse. The question remains how this small cabal of banks once again gets to drag us all down into hell so that they can make even more money?

http://www.bloomberg.com/news/2010-04-19/bank-equity-derivatives-fees-rising-as-push-for-new-rules-threatens-profit.html

http://www.nytimes.com/2010/12/12/business/12advantage.html?pagewanted=all

Login or register to post comments

Sat, 09/24/2011 - 13:56 |

Kayman

Kayman

o2sd

Liquidity has its price.

Yeah, the price started at $700 billion, grew to $10-50 trillion.

And the average citizen is paying the price daily.

Login or register to post comments

Sat, 09/24/2011 - 14:51 |

Absalon

Absalon There is no economic justification for 600 Trillion in notional amount derivatves outstanding - there is not that much risk in the world. Derivatives are being used for some other purpose and it is hard to see what legitimate purpose would support that notional value.

Login or register to post comments

Sat, 09/24/2011 - 10:12 |

disabledvet

disabledvet

let'see what happens to (the entire Continent) of Europe first. I agree "this is big." Should be quite the data dump!

Login or register to post comments

Sat, 09/24/2011 - 11:39 |

Mr Lennon Hendrix

Mr Lennon Hendrix

any reason derivatives are legal?

Ah, derivatives, talked about in finance like Lindsey Lohan on a gossip blog. A derivatives is a contract that is valued based upon the value of an underlying asset, index, or security. The are very legal, and logical as long as the risk is covered both ways, and this is important concerning counter party risk. If there is an asset, then it can be owned. It can be owned and traded two ways: bought and sold.

The problem starts with the loophole that you do not need to own the underlying security, although i can be owned, you just need to think you can locate it- and this is what we call trading naked. Although this too seems logical, it is not a responsible way of trading; here's why:

Barclays has an exchange traded fund that is suppossed to hold gold, and one for silver too. These are the infamous GLD and SLVs. They say they have all of this PM. So then others, like JPM, can use these holdings to locate their shorts. You see, the derivatives of the holdings are floating around somewhere. In conclusion, JPM can now, and does, have a massive short position due to being able to locate silver due to Barclays ishares trusts.

Does Barclays have the gold/silver? They may have some, but who says they have not issued more shares than ounces in respect to their holdings?

Login or register to post comments

Sat, 09/24/2011 - 14:02 |

Kayman

Kayman

Mr Lennon Hendrix I think we all know that all commodities, including PM's, FX, and CDS are leveraged to the moon, over and above the underlying assets. The derivatives market serves its main purpose, the generation of fees and the off-loading of risk onto unrelated third parties-the taxpayer.

Login or register to post comments

Sat, 09/24/2011 - 14:14 |

Mr Lennon Hendrix

Mr Lennon Hendrix

right? So....

Login or register to post comments

Sat, 09/24/2011 - 07:11 |

phungus_mungus

phungus_mungus

The fuse was lit on this bad bitch long time ago... BOOOOOOM!!!!!

Its about fucking time someone put this in print!

Login or register to post comments

Sat, 09/24/2011 - 07:12 |

Sutton

Sutton These banks have the most sophisicated risk management systems in the world. What can go wrong?

Login or register to post comments

Sat, 09/24/2011 - 07:27 |

o2sd

o2sd

These banks have the most sophisicated risk management systems in the world.

I doubt it. Having worked on many risk management systems, US banks are about the worst, closely followed by the UK and then Japan.

The problem is, the better your risk management system is, the higher your Tier 1 capital number ends up being. US banks are full of cowboys that don't want capital charges against their desk lowering their bonus (less coke and hookers), so the front office does everything in it's power to make sure that the risk management system is as bad as possible.

Add to this that the SEC and FINRA are clueless, toothless bumblers, and you have a recipe for disaster ... over and over again.

Login or register to post comments

Sat, 09/24/2011 - 09:21 |

LetThemEatRand

LetThemEatRand

There is a rabid political ideology that wants to let the coked up cowboys run the world without any pesky government interference or evil regulations. They believe too much regulation is the problem. I think a guy named Greenspan once mentioned something about it. Later admitted he was wrong but still couldn't understand how it could be that coked up cowboys didn't do what was best for their shareholders.

Login or register to post comments

Sat, 09/24/2011 - 10:08 |

o2sd

o2sd

There is a rabid political ideology that wants to let the coked up cowboys run the world without any pesky government interference or evil regulations.

Are the followers of this ideology called Randiots?

Login or register to post comments

Sat, 09/24/2011 - 11:02 |

LetThemEatRand

LetThemEatRand

Lucky guess!

Login or register to post comments

Sat, 09/24/2011 - 12:13 |

fxrxexexdxoxmx

fxrxexexdxoxmx Soro's bitch Obama wants to be the leader!

Login or register to post comments

Sat, 09/24/2011 - 07:12 |

kito

kito

Thanks tyler, as if this week wasnt enough to turn me alcoholic, this post mightve just put me over the edge.......

where...is...that....red....pill....antidote...?.......

Login or register to post comments

Sat, 09/24/2011 - 10:20 |

RSloane

RSloane

I'm thinking Bloody Marys with eggs for breakfast. Or I can just skip the eggs.

/hic

Login or register to post comments

Sat, 09/24/2011 - 14:09 |

Kayman

Kayman

kito

Come on Kito, take another suck on that Hopium Hookah.

No need see where the rubber hits the road.

Now where are those red shoes, Tinman....

Login or register to post comments

Sat, 09/24/2011 - 07:13 |

joe.schmuck

joe.schmuck

Kudos Tyler, reporting on the OCC report can only be found at ZH.

Have to admit "bilaterally netted" brought other thoughts to mind, but it is Sat night here...

Login or register to post comments

Sat, 09/24/2011 - 09:07 |

PontifexMaximus

PontifexMaximus Contraryinvestor.com used to discuss it too, but those bay area guys unfortunately closed....

Login or register to post comments

Sat, 09/24/2011 - 07:16 |

zhandax

zhandax

Oh wretch, thou debaseth the currency....

http://www.ronpaulforums.com/showthread.php?206841-Penalty-for-Debasing-...

Login or register to post comments

Sat, 09/24/2011 - 07:43 |

williambanzai7

williambanzai7

Gee wiz, the US has manageable exposure to European Banks.

Login or register to post comments

Sat, 09/24/2011 - 08:33 |

Tao 4 the Show

Tao 4 the Show

Banzai, this is hilarious. Just need to show the megatons of destructive power.

Login or register to post comments

Sat, 09/24/2011 - 09:22 |

AssFire

AssFire

Seems Bernanke's has multiple warheads..highly destructive.

Login or register to post comments

Sat, 09/24/2011 - 09:52 |

fishface

fishface

Who is that little suicide bomber on the left ?

Login or register to post comments

Sat, 09/24/2011 - 10:18 |

RSloane

RSloane

I believe that is Little Timmy Geithner.

Login or register to post comments

Sat, 09/24/2011 - 11:49 |

Sambo

Sambo

LOL!

Who is he going to blow up? All those 65+ yr old retirees? (Buffet hasn't retired yet)

Login or register to post comments

Sat, 09/24/2011 - 07:17 |

Tao 4 the Show

Tao 4 the Show

If these banks run 30x leverage, they should have some $8T in real assets backing the $250T in derivatives.

I bet that backing is also largely an apparition. The whole mess is financial numerology to justify the only real money in the equation: that's the part the management pulls out for themselves in salaries, bonuses, etc.

If humans survive (in some state of sanity) for a few decades, schoolchildren will gasp as they learn about the John Law's of our day and the stupidity of the masses who were taken in by the scam.

Login or register to post comments

Sat, 09/24/2011 - 07:33 |

Crash N. Burn

Crash N. Burn In case anyone needs a "John Law" refresh:

http://worldwideponzicollapse.blogspot.com/2011/09/silver-sale-continues...

Login or register to post comments

Sat, 09/24/2011 - 10:19 |

RSloane

RSloane

I did. Thanks for posting that.

Login or register to post comments

Sat, 09/24/2011 - 12:21 |

Crash N. Burn

Crash N. Burn You are very welcome

Login or register to post comments

Sat, 09/24/2011 - 08:00 |

o2sd

o2sd

If these banks run 30x leverage, they should have some $8T in real assets backing the $250T in derivatives.

Not exactly. Economic capital requirements for loans is based on leverage however, for derivatives economic capital is calculated as a multiple of Value At Risk. It would be interesting to know what VaR these 4 banks are reporting.

Login or register to post comments

Sat, 09/24/2011 - 08:49 |

Tao 4 the Show

Tao 4 the Show

Thanks for pointing that out.

Let's see, since the net value of all assets in the U.S. Is probably only around half of that $250T derivative valuation, we should not have more than $125T at risk. How can we risk more than we have?

Oops, forgot. We can mortgage the future!

Hmmm, maybe that's why we have taxpayer bailouts based on future obligations.

Yo Bernanke - man the long bonds.

(On a more serious note, the 30-40x leverage is bad enough. Using VaR just creates more vaporware by making the actual multiplier bigger. What isn't at risk in the fantasyland they call banking?)

Login or register to post comments

Sat, 09/24/2011 - 09:29 |

Tao 4 the Show

Tao 4 the Show

For those interested:

"VaR calculates the worst expected loss over a given horizon at a given confidence level under normal market conditions."

Alternate definition by Barry Schacter:

"a number invented by purveyors of panaceas for pecuniary peril intended to mislead senior management and regulators into false confidence that market risk is adequately understood and controlled."

Formerly sane humans should at this point bifurcate into those weeping uncontrollably in their soup and others laughing maniacally while shaking their fists at the gods.

That $250T is built on 30-40x a base and that base is essentially fabricated from nothing. It's all complete madness - just air. And the wizards of finance magically extract billions in salaries and bonuses from that air. Or so it would seem. In truth, they extract it from those who work for a living, and increasingly, from those not yet even born.

Login or register to post comments

Sat, 09/24/2011 - 14:18 |

Kayman

Kayman

Tao 4 the Show

VaR

"a number invented by purveyors of panaceas for pecuniary peril intended to mislead senior management and regulators into false confidence that market risk is adequately understood and controlled."

Formerly sane humans should at this point bifurcate into those weeping uncontrollably in their soup and others laughing maniacally while shaking their fists at the gods.

That $250T is built on 30-40x a base and that base is essentially fabricated from nothing. It's all complete madness - just air. And the wizards of finance magically extract billions in salaries and bonuses from that air. Or so it would seem. In truth, they extract it from those who work for a living, and increasingly, from those not yet even born.

Beautiful, Succint, worth repeating. Thank you.

Login or register to post comments

Sat, 09/24/2011 - 10:21 |

disabledvet

disabledvet

"we the people" had no choice in this. this was "choiced" upon us. i sense ferment among the natives. i recommend wads of cash...just in case.

Login or register to post comments

Sat, 09/24/2011 - 07:33 |

PaperWillBurn

PaperWillBurn $333 Trillion - The derivative exposure of 25 banks

$6 Trillion - The value of all gold ever mined in the last 5000 years

any questions?

Login or register to post comments

Sat, 09/24/2011 - 09:10 |

LeonardoFibonacci

LeonardoFibonacci

Yes. How do i get some gold?

Login or register to post comments

Sat, 09/24/2011 - 10:25 |

disabledvet

disabledvet

that's easy Leonardo. "i am a banker and i have much gold. i will sell you some provided you don't mind me lending you money." Of course "you realize your government has already agreed to this deal."

Login or register to post comments

Sat, 09/24/2011 - 11:46 |

Mr Lennon Hendrix

Mr Lennon Hendrix

You could try panning. It is a nice workout too.

Login or register to post comments

Sat, 09/24/2011 - 07:34 |

BennyBoy

BennyBoy

If its insurance, where are the regulators?

If its gambling, where are the regulators?

These "banks" aren't too big to fail.

They are too big to succeed.

Login or register to post comments

Sat, 09/24/2011 - 07:40 |

HD

HD

Wait. Just wait. 250 TRILLION? TRILLION...with a "T"? 2010 World GDP was approximately 63 Trillion.

HOW THE HELL DO YOU UNWIND 250 TRILLION?

Login or register to post comments

Sat, 09/24/2011 - 07:49 |

Motley Fool

Motley Fool

'Gradually... then suddenly'

;)

Login or register to post comments

Sat, 09/24/2011 - 08:20 |

Withdrawn Sanction

Withdrawn Sanction

+1.618

Login or register to post comments

Sat, 09/24/2011 - 08:24 |

Sri

Sri Two words: Bernanke and FED

Login or register to post comments

Sat, 09/24/2011 - 11:52 |

Mr Lennon Hendrix

Mr Lennon Hendrix

Three words: Bernanke, the FED....lose.

Login or register to post comments

Sat, 09/24/2011 - 09:15 |

PAUL LEO FASO

PAUL LEO FASO

The answer on how to unwind $250 Trillion lies here with the ultimate solution;

http://www.zerohedge.com/print/365866

Login or register to post comments

Sat, 09/24/2011 - 14:10 |

Hulk

Hulk

"HOW THE HELL DO YOU UNWIND 250 TRILLION? "

By taking out a second you silly!

Login or register to post comments

Sat, 09/24/2011 - 08:03 |

Smithovsky

Smithovsky Regulators: "$250 trillion? There's no way anything can go wrong there. Back to sleep, boys, we got government jobs so that we would have high pay and job security, not to actually do something useful."

Login or register to post comments

Sat, 09/24/2011 - 07:49 |

AssFire

AssFire

The Bible teaches, "The rich ruleth over the poor, and the borrower is the servant to the lender" (Proverbs 13:22).

The Bible also teaches, "The wicked borroweth and payeth not again" (Psalms 37:21a).